Air suspension "equal rights", domestic rise and global attack double play

In the automobile industry, there is a term that is not familiar to the public, but enjoys a high reputation in the professional circle, and that is air suspension. In recent years, air suspension, once regarded as the exclusive configuration of luxury cars, is now accelerating to the mass market.

If we trace back to the development of air suspension, this popular trend has been blowing for several years. More and more star models equipped with air suspension are ready to come out, from /L8/L9 to Weilai, Kelp, and now, the guide price of air suspension has dropped to less than 200,000, further promoting the heat of air suspension.

According to the latest statistics of intelligent driving configuration database of Geshi Automobile Research Institute, from January to December, 2024, the sales volume of new cars with standard air suspension in China was about 816,000, and the penetration rate reached 3.6%. In the same period of 2023, the sales volume of new cars with standard air suspension was 564,000, the penetration rate was 2.7%, and the carrying capacity increased by 44.7% year-on-year. It can be predicted that the development speed of air suspension market will continue to accelerate.

On the one hand, the permeability of air suspension is increasing, and its development speed has exceeded market expectations. At the same time, the supporting price of air suspension is also rapidly sinking, which is close to the standard range of about 200,000 yuan. On the other hand, with the increasing market share of air suspension, the competition between domestic suspension and foreign suspension will become more and more fierce.

The breakthrough of technology, the reduction of cost and the rapid growth of market demand have provided a strong impetus for the popularization of air suspension. Then, will the road of "popularization" of air suspension be smoother and smoother?

The pattern is stable, and domestic substitution is just the time.

Judging from the development in 2024, the market structure of air suspension still continues the characteristics of the rise of domestic forces, and the concentration is getting higher and higher. In 2024, local manufacturers accounted for more than 80% of the air suspension market.

In recent years, the air suspension market has shown a highly concentrated competition pattern, and domestic suppliers have opened a lot of gaps with overseas brands by virtue of technological progress and cost advantages. In 2024, the installed capacity of air suspension market exceeded 800,000 sets, among which Konghui Technology ranked first with 335,470 sets of installed capacity, with a market share of 41.3%. Kong Hui Technology’s market penetration in the field of new energy vehicles is particularly prominent, and its technical advantages enable it to provide customized air suspension solutions for car companies to meet the needs of different models.

Top Group followed closely, with an installed capacity of 209,760 sets and a market share of 25.8%. Top Group occupies an important position in the middle and high-end vehicle market through continuous technological innovation and cost control. Its products are not only comparable to imported brands in performance, but also more competitive in price, which promotes the application of air suspension in more models.

Baolong Technology ranked third with an installed capacity of 159,535 sets, with a market share of 19.6%. Baolong Technology has further consolidated its market position with its own research and development capabilities and customer resources. Its air suspension system is excellent in performance, reliability and cost control, especially in the promotion of low-end market.

In contrast, the market share of traditional international suppliers such as Wayback and Continental Group is 7.8% and 5.0% respectively. As an internationally renowned supplier, Weiback mainly serves high-end brand vehicles, while Continental Group is relatively deep in technology accumulation, but slightly conservative in market competition.

From the overall market point of view, the top five suppliers account for nearly 90% of the market share, and the market concentration is getting higher and higher. These leading enterprises rely on their strong R&D strength and market influence to continuously promote the progress of air suspension technology and market expansion. In the future, with the further maturity of technology and the reduction of cost, air suspension system is expected to be applied in more models, further promoting the growth of market demand.

The rise of domestic brands in the air suspension market is not accidental, and there are many key factors behind it.

From the most intuitive point of view, the development of the new force of building cars has given more opportunities to local air suspension suppliers. For example, Lantu Automobile gave Kong Hui tickets, which verified Kong Hui’s technical accumulation for many years; Ideal helps Kong Hui become a qualified supplier of auto parts. These stories are still vivid, and now the cooperation between new power enterprises and domestic air suspension enterprises is getting closer and closer, and both sides grow together.

In addition, domestic brands have made a significant breakthrough in air suspension technology, which is not only equivalent to imported brands in performance, but also excellent in cost control. In 2023 -2024, domestic air suspension experienced two or three iterations, from single cavity to mainstream dual cavity, which led to great changes in the whole product line and significant cost reduction. This cost advantage enables domestic brands to provide air suspension configurations for more low-end models, thus expanding market share.

"Quick response and supply chain stability are also one of the advantages of domestic air suspension enterprises." Wang Lin (pseudonym), a person in the auto parts industry, pointed out that compared with foreign suppliers, domestic brands have more advantages in development cycle and response speed. The development cycle of foreign suppliers is usually longer, while domestic brands can respond to market demand more quickly and provide flexible solutions. In addition, domestic brands have also performed well in the stability of supply chain and can better cope with market fluctuations.

It is imperative for air suspension to get on the bus on a large scale.

From the whole analysis logic point of view, electrification has greatly changed the load-bearing system of automobiles, and the rapid development of new car-making forces has laid the foundation for the high-end brand of automobiles in China. This also means that the popularity of electric vehicles has brought opportunities for the wide application of air suspension.

The sale of electric vehicles is much more, which makes the air suspension widely used; There are more new forces to build cars, which gives local suppliers more opportunities; Only when the brand of China is high-end can it accommodate the cost of air suspension.

The permeability data of air suspension also illustrates some problems. According to the analysis of intelligent driving configuration data of Geshi Automobile Research Institute, from January to December, 2024, the highest monthly penetration rate of air suspension configuration reached about 4.4%, and the monthly supporting capacity exceeded 100,000 sets, entering an explosive growth stage. The carrying capacity gradually increased from 25,000 sets at the beginning of the year to the peak of 76,000 sets in June and 102,000 sets in December, indicating the steady growth of market demand. At the same time, the permeability started from 1.9% in February and rose in fluctuation, reaching 4.5% in June, indicating that the acceptance of air suspension standard in the market is increasing day by day.

We also see that the development of domestic air suspension enterprises is in full swing. For example, in 2024, Baolong Technology announced the number of designated projects as high as 28, involving an amount of over 11 billion yuan. These projects not only demonstrated the technical strength of Baolong Technology, but also laid the foundation for the large-scale application of air suspension.

A series of indications show that the large-scale popularization of air suspension is close at hand. At one time, air suspension was more common in high-end luxury models, such as, and so on, and its high cost made it difficult to widely promote it. However, with the rise of domestic suppliers, the cost of air suspension is significantly reduced, and the price of vehicles equipped with this configuration is also more close to the people.

Taking 2024 as an example, air suspension has been applied in 200,000-yuan models. It is a typical representative, and the starting price of its model equipped with air suspension is only 289,800 yuan. In addition, the starting price of the latest Krypton 001 is 259,000 yuan, and the air suspension can be optional for the entry model. What is more noteworthy is that the dark blue G318 is equipped with an air suspension version, and the starting price is only 199,900 yuan.

"At present, there is an obvious sinking trend of air suspension on new energy vehicles, and it is likely to further drop to 180,000-190,000 in the future." Wang Lin believes that the standard value of air suspension will be lowered, and the possibility of getting on the bus on a large scale is very high.

However, Wang Lin also added his own analysis. From the aspects of quality, design process and overall cost (including maintenance cost), there is limited room for the cost of air suspension to sink further. From the perspective of cost analysis, he pointed out that it is difficult to reduce the cost of even a single-cavity air spring, because the whole air suspension system includes the body and the supply system, such as air pump, air valve, compressor, gas storage tank and sound insulation layer. The development cost of the system has dropped from about 2000 yuan before to about 1800 yuan at present. Unless domestic manufacturers make breakthroughs in core components, it is unlikely that the cost will be further reduced.

In the future, with the further development of technology and the continuous reduction of cost, air suspension is expected to be applied in more models. Therefore, it is predicted in the industry that the overall permeability of air suspension will reach about 15% in 2025. With the development of intelligent suspension technology, air suspension will be combined with more intelligent driving functions to provide consumers with more intelligent and personalized driving experience.

What is the odds of air suspension going out to sea?

When the domestic air suspension market structure is relatively stable, the competition is becoming more and more fierce. Therefore, we have also seen a new trend. With the maturity of domestic air suspension technology and the improvement of market competitiveness, domestic suppliers have begun to look to the international market.

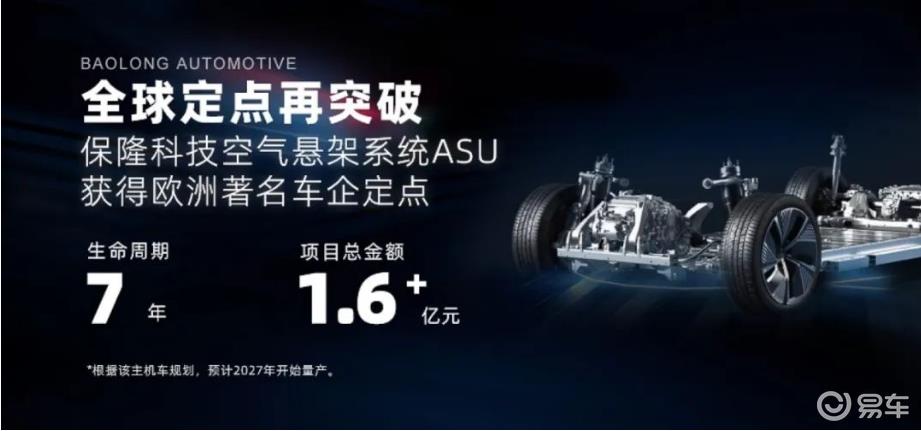

Recently, Baolong Technology received the Notice of Fixed Point from a famous European automobile company, and became a component supplier for its brand-new platform project, Air Supply Unit (ASU) of air suspension system. The life cycle of the project is 7 years, and the total amount exceeds RMB 160 million. It is expected to start mass production in 2027. This indicates that the domestic air suspension technology has been recognized by the international market, laying a foundation for the further expansion of domestic suppliers in the international market.

However, we also need to see the challenge of domestic air suspension forces going out to sea. Judging from the overall market structure, foreign air suspension forces are not in a strong position in the China market. For example, although Kangdi has built a factory in Jiangsu to promote localization, its speed is slow; Weiback, on the other hand, relies entirely on imports and has not yet set up a factory in China. However, they are in a strong position in the international market.

In the international market, the field of air suspension has long been monopolized by a few foreign giants. Condi (affiliated to Continental Group) and Weiback are two giants in the global market, and they have absolute advantages in technology and market share. Japanese manufacturers also mainly rely on the products of Condi and Weiback in the luxury car field, and almost no domestic products are used.

Domestic air suspension enterprises also clearly realize that the road to sea is not smooth sailing. As Chao Wang, general manager of Baolong Science and Technology Supply Chain Development Center, said, when China enterprises enter the international market, they are often restricted by many factors. Whether an enterprise can win a project order depends not only on whether the product is excellent and whether the price is competitive, but also on many other complex factors that may affect the cost control, delivery ability and cooperation experience with customers.

Wang Chao also added, "Maybe after we go, we can still build a certain advantage through a period of adaptation, but this advantage may not be so obvious compared with our advantage in China."

To this end, Baolong Technology needs to solve the possible challenges from the perspective of supply chain. In 2024, Baolong Technology established a new department supply chain development center. In addition to optimizing the procurement strategy, another important task of the new department is to strengthen the overseas supply chain.

In fact, Baolong Technology started earlier in overseas layout, and had previously set up some factories overseas. Today, Baolong plans to build more purely overseas supply chains. Chao Wang said that although Baolong had some overseas factories before, the original supply chain was still dominated by China supply chain. Now, due to geopolitical problems, many customers demand the localization of supply chain, so the new department will help overseas factories to establish a purely overseas supply chain.

However, in his view, compared with foreign-funded enterprises, China enterprises still have a comparative advantage. "For example, in terms of efficiency, if a China supplier can complete a project in six months at home, a foreign investor in China will complete it in nine to twelve months, and if it goes to Europe, a China supplier may complete it in nine months, and a foreign investor may complete it in 12 to fifteen months. This step difference also exists. Of course, this data description is not for specific projects, but mainly for an image description. "

Despite the challenges, Chao Wang is full of confidence in the future development. He believes that in the next few years, China suppliers will gradually catch up. "Generally speaking, China suppliers will be able to provide products with advanced technology, good quality and competitive cost in the future."

With the continuous progress of technology and the further reduction of cost, domestic suppliers are expected to occupy a more important share in the international market and contribute more to the global development of air suspension.

Gai Shi Xiao Ji

Air suspension is moving from high-end to mass, which is driven by many factors, such as technological breakthrough, cost reduction, market demand growth and the rise of domestic suppliers.

With strong R&D strength and cost advantage, domestic suppliers have gained significant market share in the domestic market and started to expand into the international market. With the further development of technology and the continuous expansion of the market, air suspension is expected to become the choice of more ordinary consumers and inject new impetus into the intelligent and comfortable development of the automobile industry.

Perhaps, in the near future, air suspension will not only become the standard in the domestic automobile market, but also occupy an important position in the global market.