Rare earthquake! Biden speaks! US GDP data is not as good as expected, and the market interest rate cut is expected to be postponed.

On Thursday, April 25th, EST, the GDP of the United States in the first quarter increased by 1.6% year-on-year, far lower than the 2.4% predicted by economists. The three major stock indexes closed down across the board, and the yield of US bonds climbed.

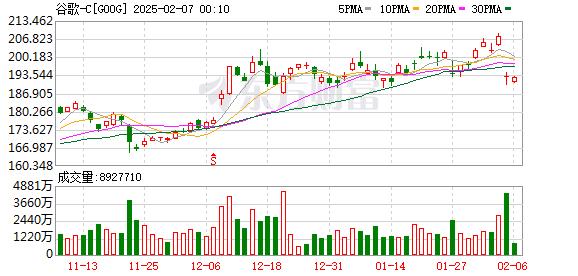

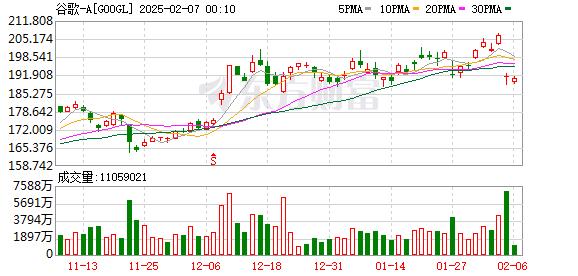

Google’s parent company Alphabet’s revenue and earnings in the first quarter exceeded expectations, and announced a dividend for the first time. After-hours share price rose by more than 14%.

IBM recorded the biggest intraday decline since 2021, and the performance of the consulting department disappointed investors.

American oil fell after the release of GDP data, and then rebounded by nearly 1%, closing at a new high of more than a week.

GDP data is less than expected.

Market interest rate cuts are expected to be postponed.

The GDP growth rate of the United States in the first quarter was lower than expected. In the first quarter of the United States, the initial value of the annualized rate of real GDP rose by 1.6%, which is expected to rise by 2.4%. In the fourth quarter of last year, the final value rose by 3.4%, the revised value rose by 3.2%, and the initial value rose by 3.3%.

The GDP data hit the market’s interest rate hike expectations, and traders postponed the Fed’s first interest rate cut this year to December.

Another data shows that the annualized initial value of the core PCE price index in the first quarter of the United States rose by 3.7% month-on-month, and it is expected to rise by 3.4%. In the fourth quarter of 2023, the final value rose by 2.0%, the revised value rose by 2.1%, and the initial value rose by 2.0%.

Nick Timiraos, the "mouthpiece of the Federal Reserve", pointed out that Thursday’s GDP report sounded the latest alarm for investors and Fed policy makers, who have been holding their breath and expecting that falling inflation will officially start to cut interest rates this summer.

After the data was released, US President Biden said in a statement that the economic data released on Thursday showed that the US economy "remained strong and continued to grow steadily".

Biden also stressed that the unemployment rate has remained below 4% for more than two years. "But we have more work to do. For working families, the cost is too high, and I am trying to reduce the cost. " Biden said.

At the close, the Dow fell 0.98% to 38,085.8 points; The S&P 500 index fell 0.46% to 5048.42 points; The Nasdaq fell 0.64% to 15,611.76 points.

The yield of US bonds rose, with the yield of 2-year bonds once exceeding the 5% mark, and the yield of 10-year bonds rose by 6.7 basis points to 4.721%.

Alphabet’s share price rose sharply after hours.

Most of the technology stocks fell, and the TAMAMA technology index of the United States fell by 1.24%.Up by 4.97%,Up by 0.51%,Down 1.65%,Up 1.74%, Google down 1.94%, Facebook down 10.56%,It fell by 2.45%.

Google’s parent company, Alphabet, announced its first-quarter earnings report, with revenue and net profit exceeding market expectations. Revenue is 80.54 billion US dollars, and it is expected to be 79.04 billion US dollars; The net profit is $23.662 billion, and it is expected to be $19.6 billion.

Google Cloud, Google Advertising and YouTube advertising revenues all exceeded expectations. Google Cloud’s revenue is $9.57 billion, which is expected to be $9.37 billion. Google’s advertising revenue is $61.66 billion, which is expected to be $60.18 billion. YouTube advertising revenue in the first quarter was $8.09 billion, which is expected to be $7.33 billion.

In addition, Alphabet announced that the board of directors approved the start of a cash dividend of $0.20 per share and authorized the repurchase of shares not exceeding $70 billion.

Affected by the above news, Google rose more than 14% after hours.

Earnings per share in the third fiscal quarter was $2.94, which is expected to be $2.83; Realized revenue of 61.858 billion US dollars, which is expected to be 60.885 billion US dollars; The net profit was $21.939 billion, which is expected to be $21.16 billion. Intelligent cloud’s revenue is $26.71 billion, which is expected to be $26.25 billion.

Us stocks rose more than 4% after hours.

Sales of IBM consulting business are weak.

The biggest intraday decline in three years

IBM’s revenue and net profit were lower than expected, with revenue of $14.46 billion in the first quarter, which is expected to be $14.55 billion; Realized a net profit of $1.61 billion, which is expected to be $1.16 billion.

Investors have been paying attention to the fact that the revenue of IBM’s second largest business consulting department in the first quarter was $5.2 billion, which was the same as last year. The market thinks that it may decline in the future.

At the same time, IBM announced that it will acquire HashiCorp, a software company, for $35 per share in cash, with a corporate valuation as high as $6.4 billion. This is IBM’s biggest acquisition since it acquired the software company RedHat for $31.8 billion in 2019.

On Thursday, IBM once fell by 10%, the biggest intraday decline since 2021. Finally closed down 8.25%.

US oil fell first and then rebounded.

On Thursday, the price of WTI for June delivery rose 76 cents, or 0.92%, to close at $83.57 a barrel.

After the GDP data was released, the futures price once fell by 36 cents, or 0.43%, to $82.45 per barrel.

China assets performed well.

Most of the popular Chinese stocks rose.It rose by 8.89% and Shuodi Bio rose by 7%.The group rose by 6.82%,Up by 5.06%,Up by 4.06%,Up by 3.32%,Up by 3.08%,Up 2.46%,Up 2.14%.

In terms of decline,Down 6.19%,The live broadcast fell by 4.34%.Down 3.07%,It fell by 2.88%.

ZhongbiaoCar stocks are mixed,Cars fell by 0.49%,Up by 0.07%,It fell by 1.68%.