Fulin village in Qijiang: the village is beautiful, the people are rich, the industry is prosperous, and the countryside is picturesque.

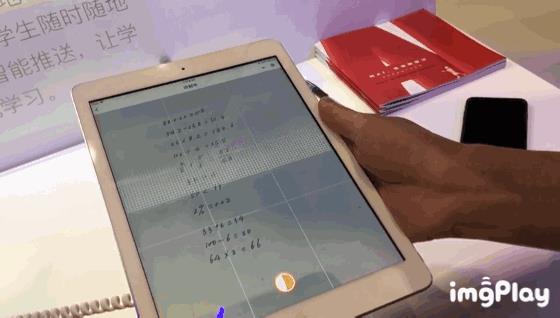

Workers in Fuliu Fruit and Vegetable Farm in Fulin Village are transplanting corn seedlings. Photo by Yan Ningbo

Fulin Village, Dongxi Town, Qijiang District, 5 kilometers away from Dongxichang Town, has 10 villagers’ groups under its jurisdiction, with a total of 3,245 people in 961 households. In recent years, Fulin Village, taking the construction of Hemei village as an opportunity, has made continuous efforts in promoting industrial revitalization, serving the construction of major projects, and promoting the improvement of human settlements for a long time.

Prosperous industry and increasing income of the masses

At present, it is spring ploughing and sowing. In Fuliu Fruit and Vegetable Farm in Fulin Village, we can see that in the well-regulated high-standard farmland, workers are helping seedlings, covering the soil and compacting … transplanting corn seedlings into the soil, and the fields are busy. Large tracts of newly transplanted corn seedlings are green and dripping, fluttering in the sun and showing infinite vitality.

"The farm mainly grows seasonal fruits and vegetables such as corn, jar beans, green beans, lettuce, spinach, cabbage and watermelon." Peng Zongqiang, the head of Fuliu Fruit and Vegetable Farm, worked outside for a few years and had some savings in his hand. In September 2022, he responded to the call of "returning to his hometown for development" and returned to Fulin Village to transfer 46.8 mu of land to start planting fruits and vegetables at the transfer price of 500 yuan/mu.

"At that time, these lands had been transformed into high-standard farmland, and tractor roads and irrigation canals were also repaired to farms." Peng Zongqiang said that the complete infrastructure has saved a lot of time and economic costs and greatly enhanced the confidence in development. With the strong support of Murakami, the farm was soon built and put into production.

In order to increase the output of fruits and vegetables and realize large-scale and standardized production, Peng Zongqiang’s fruit and vegetable farm cooperates with Chongqing Institute of Modern Agricultural Technology and Equipment. The research institute provides technical support for the farm in soil improvement, breeding and seedling raising, fertilizer application and pest control.

"Last year, when some vegetable markets were not very good, the gross income of the farm was more than 200,000 yuan." Peng Zongqiang said frankly.

After Peng Zongqiang’s fruit and vegetable farm settled in Fulin Village, it provided employment opportunities for more than 20 villagers around. Li Yixian, 60, is one of them. As a "long-term worker" in the fruit and vegetable farm, she is responsible for turning over the soil, raising seedlings, harvesting, etc. She walks through the fruit and vegetable farm every day, which is both busy and fulfilling. "I work here, I have something to do every day, and I have a fixed income of 1,600 yuan a month." Li Yixian said.

"Next, we will cooperate with the village to build greenhouses to further expand the scale, and at the same time build corridors to turn the farm into a modern farm integrating farming experience and leisure and sightseeing, so as to drive more villagers to get rich together." Peng Zongqiang said.

In Fulin Village, Peng Zongqiang is not a case. According to Zhao Fulong, the village’s first resident secretary, in recent years, the village has continuously improved its infrastructure, introduced owners and guided farmers, and vigorously developed more than 500 mu of fruit and vegetable industries such as pepper, radish, sorghum, rape, lotus root and watermelon according to local conditions. In 2023, it achieved sales income of more than 700,000 yuan, which effectively boosted villagers’ income, and at the same time, the village collectively earned more than 50,000 yuan. In addition, the village collective also established Chongqing Xiyu Construction Labor Service Co., Ltd. to undertake projects such as canals, fire pools and village-level highway maintenance, with an annual income of over 200,000 yuan.

Service projects promote development together.

In April, at the construction site of Fulin Reservoir Project in Fulin Village, excavators waved their long arms, engineering vehicles shuttled back and forth, and construction workers performed their duties … everywhere was a scene of intense construction.

"I come here every day to have a look, and I hope it will be repaired soon." Wu Yongwan, 60, lives nearby and visits the observation deck every day. In his words, "I haven’t seen it for decades. It’s beautiful."

As a key construction project at the municipal and district levels, the total estimated investment of Fulin Reservoir Construction Project is 749 million yuan, which is a medium-sized water conservancy project with the functions of agricultural irrigation and water supply for towns and towns, and comprehensive utilization of drinking water for rural people and livestock in irrigation areas. After the project is completed and put into use, it will meet the irrigation water demand of 16,000 rural residents, 69,200 town residents and 36,800 mu of farmland in 18 villages in Dongxi, Ganshui and Zhuantang.

In recent years, Fulin Village has focused on "good governance" and made great efforts to improve the effectiveness of rural governance in accordance with the working methods of "good organization, perfect mechanism, and good publicity by the masses" and "three goodness".

Good organization means giving full play to the exemplary role of the Party organization’s fighting fortress and the vanguard of party member, demonstrating and driving villagers to be the "protagonists" in rural construction, and actively participating in the construction and development of Fulin Village. Perfecting the mechanism means establishing and perfecting the "three ones", "three musts" working method and "three guarantees" gridding mechanism, so as to resolve various contradictions and disputes in the bud and achieve "everything has an explanation, everything has a landing, and everything has an echo". The masses promote kindness, that is, fully mobilize the enthusiasm of the masses to participate in self-government, set up a "Fulin Sunset Red" volunteer service team, carry out various volunteer services around the needs of villagers, and set up a village-level parliamentary hall to form a new pattern of rural governance that "everyone has something to discuss, talk about it together, and help together when it is difficult".

Renovating the environment and "refreshing" the village face

Fangfei in April, the spring is bright and warm. A winding country road runs from the head of Fulin village to the end of the village. Along the way, surrounded by clear water, birds singing and flowers fragrant, a patchwork of houses, a clean and bright small courtyard, and a unique wall painting … what a beautiful and peaceful picture of the countryside.

"Every household builds a garden, roads are swept and garbage is collected." Speaking of Fulin Village today, Zhao Fulong is like a few treasures. Since 2022, with the support of the Agricultural and Rural Committee of Qijiang District and the government of Dongxi Town, Fulin Village has invested 2 million yuan to upgrade the overall living environment of the village. After that, Fulin Village has changed its former appearance and its face value has improved significantly.

In order to continuously consolidate the improvement effect of human settlements and create a clean, tidy and orderly human settlements, Fulin Village regards the participation of human settlements and village-level public welfare undertakings as an important criterion for party member and the masses to evaluate the quality, and actively carries out the selection of "demonstration households of human settlements", "Hemei families", "civilized households" and "sanitary households" to fully mobilize the enthusiasm of the masses and form a good situation in which everyone participates in the improvement and maintenance of human settlements.

"Now not only is the village clean, but the villagers’ consciousness has also improved." Pu Degui, a 58-year-old villager, bought a house in Chongqing and wanted him to go to the city to enjoy himself. Feeling the changes in the village in the past two years, Pu Degui said frankly: "I don’t want to go to town. If you have nothing to do, you can get flowers at home, wait for the grass, or go out and have a look, which is particularly comfortable. "

"In the next step, we will firmly seize the opportunity of the construction of Fulin Reservoir, incorporate the ladder homestay, the Four Seasons Fruit Garden and the trail around the lake into the development plan of our village, and combine the characteristics of Fulin to create an recognizable brand of Fulin agricultural tourism, promote rural revitalization, and make the villagers feel more, happier and more secure." Zhao Fulong said. (Qin Ningbo, Wang Yu, Gu E)